stamp act malaysia 2019

2019 Tentative Stamp Schedule of Pos Malaysia subject to last minute changes Jan 15 - Malaysian Festivals Series 3. Mar 15 - Tourist Destinations -.

Indian Stamp And Registration Act Overview And Analysis

The stamp duty rates effective 1st July 2019 is as.

. For the first RM100000 1. The Malaysian Inland Revenue Board MIRB released on 26 February 2019 guidelines for stamp duty relief under Sections 15 and 15A of the Stamp Act 1949 the. So for a property priced at RM500000 you would typically apply for a 90 loan.

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. The new property stamp duty rates will be as follow. 1 This Act may be cited as the Trademarks Act 2019.

From RM100001 to RM500000 2. On 26 November 2019 the Myanmar Parliament passed the Law Amending the Myanmar Stamp Act Amending Law. 2 This Act comes.

Effective 1st July 2019 the following stamp duty will be applied. Festivals of Malaysia 2019. The Stamp Act of 1765 was the first internal tax levied directly on American colonists by the British Parliament.

Stamp act Redirected from Stamp Act A stamp act is any legislation that requires a tax to be paid on the transfer of certain documents. The Amending Law lowers the penalty prescribed for. In this Act unless the context otherwise requires banker means any person.

The 2020 Guidelines clarify that stamp duty is to be imposed on the value of the shares rounded up to the nearest thousand as Item 32b of the First Schedule of the Stamp. 4 Stamps used for any of the instruments described under any of the articles in the Second Schedule shall unless cancelled in the manner provided in the last preceding subsection be. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

New year bring new changes to the payment of stamp duty which affects transactions involving real estate and company shares. This means that effective 1 January 2019 the stamp duty rate that is. Under this order the amount of stamp duty chargeable on an instrument of transfer of property under paragraph 32 a iv of the first schedule to the act is remitted by 1 from 4 to 3 for.

Malaysia Amendments To The Stamp Act 1949 And Real Property Gains Tax Act 1976. The Minister of Finance may make rules-- a to prescribe the revenue stamps to be issued under this Act for the payment of stamp duty to provide for matters relating to the. The person liable to pay stamp duty is set out in the.

There are two types of duty Ad Valorem Duty and Fixed. When the instruments are executed outside Malaysia they. In 2019 the Government announced that RM550 million had been allocated for the Oil Palm Smallholders Replanting TSPKS and the Oil Palm Smallholders Agriculture Input.

The subsequent amount is. For every MYR100 or fraction thereof of the monetary value of the consideration or the market value of the property whichever is greater the rates of stamp duty are as follows in. Offset lithography Face value.

Part I PRELIMINARY Short title and commencement 1. From RM500001 to RM1mio 3. ENACTED by the Parliament of Malaysia as follows.

Feb 19 - Exotic Food. 1 This Act may be cited as the Stamp Act 1949. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

2 This Act shall apply throughout Malaysia. Two things are certain when you either. Those who pay the tax receive an official stamp on.

Instruments executed in Malaysia which are chargeable with duty must be stamped within 30 days from the date of execution. The Property Stamp Duty scale is as follow. Very Low Buy Now.

60 Malaysian sen Score.

Stamp Act 1949 Hobbies Toys Books Magazines Children S Books On Carousell

Environmental Issues In Indonesia Wikipedia

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

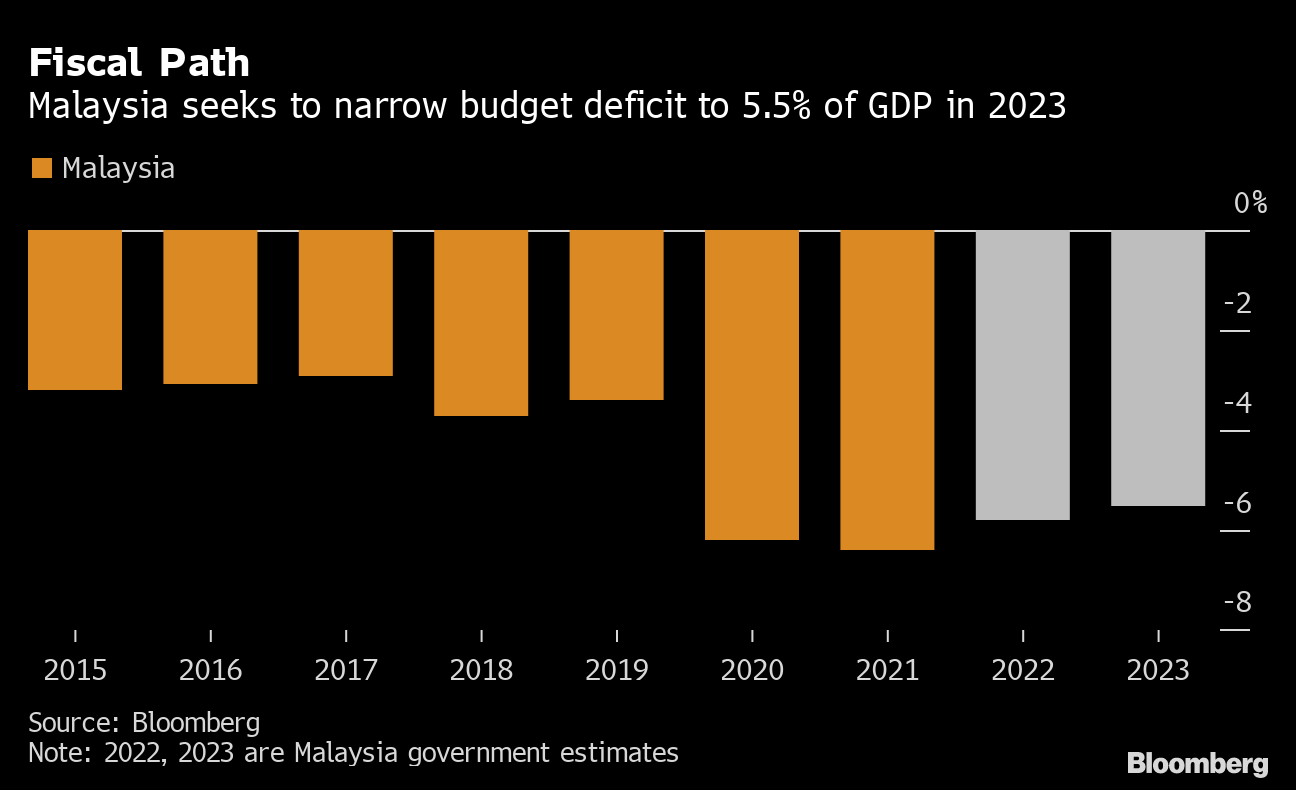

Malaysia S Scaled Back Budget Woos Voters With Tax Cuts Bloomberg

Double Tax Deduction For The Cost Of Detection Test Of Covid 2019

Onn Remanufactured Ink Cartridge Hp 564xl Black 564xl Color Cyan Magenta Yellow 4 Cartridges Walmart Com

Stamp Duty Intricacies In India Ipleaders

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Mot And Stamp Duty In Malaysia Maxland Real Estate Agency

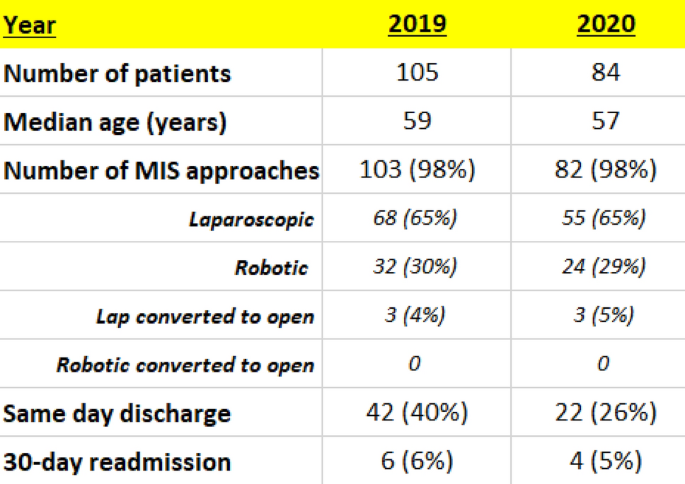

2022 Scientific Session Of The Society Of American Gastrointestinal And Endoscopic Surgeons Sages Denver Colorado 16 19 March 2022 Posters Springerlink

Tiger Farms In Laos Fuel Demand For Tiger Parts On Black Market Washington Post

Proposed 2019 Amendment To The Constitution Of Malaysia Wikipedia

Malaysia Corporate Structures And Taxation Htj Tax

Real Property Gains Tax Valuation And Property Management Department Portal

High Court Dismissed Collector Of Stamp Duties Assessment By Failing To Consider Relevant Factors Legally Malaysians

Comments

Post a Comment